Service Charges

| Sr No | Services | Charges (Uniform to all Branches) | |

|---|---|---|---|

| 1 | Minimum balance | ||

| Savings Bank A/c | |||

| Gayatri Nirbhyaya Saving Account (With out Cheque Book) | Rs. 550/- for single Rs. 1100/- for Joint account | ||

| Gayatri Nirbhyaya Saving Account (With Cheque Book, ATM/Debit Card, Mobile Banking etc.,) | Rs. 1100/- for single Rs. 1100/- for Joint account | ||

| Gayatri Pariwar | Account can be opened with zero balance. There is no requirement of minimum balance. | ||

| Gayatri No-Frills Account | Account can be opened with zero balance. There is no requirement of minimum balance. | ||

| Gayatri Saving Vidyarthi | Rs. 200/- (Joint account is not allowed in this product) | ||

| Gayatri Saving Vidyarthi (With ATM Card) | Rs. 500/- (IMPS/Mobile Banking is not allowed in this product) | ||

| Gayatri Pariwar (With ATM Card & IMPS facility) | Rs. 1000/- | ||

| Current Account | Rs. 1000/- | ||

| Gayatri Pariwar with ATM card, Mobile Banking | Account can be opened with zero balance. There is no requirement of minimum balance. | ||

| Gayatri No-Frills Account | ATM, Mobile Banking services not allowed in this product | ||

| Charges on Account facilities | |||

| 1 | Insurance Charges for Nirbhaya Saving Account. | Actuals payable to Insurance Company. Currently Rs. 28.50 per Year | |

| 2 | Inoperative account -SB Inoperative account-CA | Rs 100/- plus Taxes. Rs 200/- Plus Taxes. | |

| 3 | Issue of CTS cheque-SB | Rs 5.00 plus Taxes per cheque leaf | |

| 4 | Issue of CTS cheque- CA | Rs 5.00 plus Taxes per cheque leaf | |

| 5 | Issue of Pass book/Balance certificate | Issue of Passbook/statement -NIL Issue of Balance certificate – NIL | |

| 6 | Duplicate pass book/ Statement | Rs.50/- per Pass Book | |

| 7 | Stop payment instructions | Rs.50/-plus Tax per instrument up to 3 leaves. Range of cheques- Rs.200/- plus Tax | |

| 8 | Balance enquiry | NIL | |

| 9 | Account closure After 12 months (a/c transfer not included) | Saving Account- Rs.100/- plus Taxes Current Account – Rs. 200/- plus Taxes | |

| 10 | Cheque returned charges- cheques drawn on us. | Rs.300/-plus Taxes | |

| 11 | SMS Charges | 30 +Tax per half year | |

| 12 | Signature verification | Rs.50/- per signature | |

| 13 | Duplicate TDR in case of loss of TDR | Rs.50/- plus Taxes per Bond | |

| 14 | CASH Handling Charges at Out-station Non-base branches | Below 100/-Denomination Rs10/- plus Tax, per packet Above 100/- Denomination-Nil. | |

| 15 | CASH WITHDRAWAL at Out-station Non-base branches | Below 100/-Denomination Rs10/- plus, Tax per packet. Above 100/- Denomination-Nil. | |

| 16 | Change of authorized signatory including reconstitution of A/c. | Current, Cash Credit, Over Draft Account-Rs.100/- per change | |

| Remittance Facility | |||

| 17 | Issue of demand drafts, Banker’s cheque | NIL | |

| 18 | Revalidation/ cancellation of drafts, Banker Cheques | Revalidation: NIL Cancellation of draft…..Rs.100/-per instrument. | |

| 19 | Issuance of duplicate demand draft | Rs 100/- per draft | |

| 20 | Collection of cheques- Local | NIL | |

| 21 | Cheque Collection under – CTS | NIL | |

| 22 | RTGS/NEFT Charges | Charge per transaction (Rs.) (including time varying tariff) | |

| NEFT/RTGS-Outward | NIL | ||

| 23 | NEFT/RTGS – Inward | Nil | |

| 24 | DD/BC/Other Bank cheque Purchase Local | Interest @ 0.12% on Cheque Amount. In case of cheques returned unpaid interest at 24% p.a. after adjusting the amount collected. | |

| DD/BC/Other Bank cheque Purchase Outstation | Interest @ 0.24% on Cheque Amount. In case of cheques returned unpaid interest at 24% p.a. after adjusting the amount collected. | ||

| 25 | Cheques/ bills deposited returned unpaid, outward | Rs.200/- plus Taxes | |

| 26 | At par remittance of maturity proceeds of Time Deposits as well as periodical interest to another branch/Bank. | Free | |

| 27 | At par collection of cheques issued as per court orders for investment in Time Deposits. | Free | |

| 28 | FUND TRANSFER (Inter-Branch) | Transfer of funds through cheque amongst the customers of inter branches is Free of charge irrespective of any amount. | |

| 29 | NACH/ECS Charges | Rs 200/- Plus Taxes for registration of NACH/ECS mandate. Rs. 300/-for NACH transaction returns | |

| 30 | Setting up Standing Instructions (SI). | NIL | |

| 31 | Processing of SI (other than Bank Transfers) | NIL | |

| 32 | Charges for inability to carry out standing instructions due to insufficient balance in the account | Rs.40/- plus Taxes per occasion. | |

| 33 | Penal Charges for late payment of installment in Recurring Deposit A/c. | 2% on required EMI for delayed period. | |

| 34 | Safe deposit articles | Classic Rs.500/- plus Taxes one time charges plus, Envelope -Rs.100/- plus Taxes p.a. Package-Rs.500/- plus Taxes p.a. Large packet/Box-Rs 1000/- plus Taxes p.a. Subject to maximum total dimensions ( i.e. length+width+ height) should not exceed 100 c.m. if exceed 100 c.m. Rs 20per c.m. (subject to availability of space available) | |

| 35 | Safe custody charges a) Scrips ( for each scrip) b) Sealed cover (for each cover) c) Bank’s own deposit receipt | a) Rs. 100/- plus Taxes per script Min. Rs. 200/- p.a. or part thereof. b)Rs. 200/- plus Taxes per cover p.a. or part thereof c) NIL | |

| 36 | Transfer of Securities From pledge to safe custody. | Rs. 30/- per security per month, subject to a minimum of Rs.30/- per account. | |

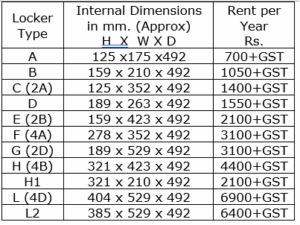

| 37 | Safe Deposit Lockers Annual charges |  Note: Rs.10,000/- plus Three years Rent should be kept as an advance during the hiring period. In case of loss of key of the Lockers, a service charge of Rs500/- has to be recovered from hirer in addition to the actual expenditure incurred for breaking open the locker and changing the lock by manufacturers of lockers. | |

| 38 | Photo attestation charges | NIL | |

| 39 | Record copy of the Cheque | NIL | |

| 40 | Interest certificate | Free of cost for 1st time, Rs.50/- per certificate for extra copy | |

| 41 | Enquiries relating to old records (more than 12 months old) | Rs 100/- per item | |

| 42 | Addition / deletion of names in Joint Accounts/Nominations/Change in operational instructions (including Lockers) | Rs.25/- per occasion. | |

| 43 | ATM Charges | ||

| Issuance | |||

| Card Type : Classic Platinum | Rs.150/- + GST Rs.225/- +GST | ||

| Contactless : Classic Platinum | Rs.200/- + GST Rs. 300/- + GST | ||

| Annual Fee | |||

| Card Type : Classic Platinum | Rs.150/- + GST Rs.225/- +GST | ||

| Contactless : Classic Platinum | Rs.200/- + GST Rs. 300/- + GST | ||

| Card Replacement Fee | Classic Card Rs 150/- plus taxes Platinum Card Rs 225/-plus taxes | ||

| Regeneration of PIN | Free | ||

| Cash withdrawal at GAYATRI BANK’s ATMs | Free | ||

| Withdrawal from other bank’s ATM (For Saving Accounts Only) | Free up to 5 transactions per month per transaction- Rs.20/- + tax from 6th transaction for Financial Transactions per transaction Rs.7/- + tax , from 6th transaction for Non Financial Transactions | ||

| Issuance of one additional card | Classic Cared Rs.150/- plus Taxes Platinum Card Rs.225/- plus Taxes | ||

| Issuance of more than one additional card | Rs. 250/- plus Taxes per card. | ||

| 44 | Gold Loan Processing Charges | NIL | |

| 45 | Recovery/Legal Action Charges | ||

| Registered notice (In Postal/Courier) | Rs. 100/- per instance | ||

| Notice under Co-Op Act (In Postal/Courier) | Actuals +Rs. 200/- plus Taxes per instance | ||

| Notice under Sec 70,71 certificates (In Postal/Courier) | Actuals +Rs. 500/- plus Taxes per instance | ||

| Notice under SARFAESI Act (In Postal/Courier) | Actuals +Rs. 200/- plus Taxes per instance | ||

| Notice in News Paper | Actuals + Rs. 500/- plus Taxes per account, per instance | ||

| Execution of Legal Auction | Actuals + Rs. 500/- plus Taxes per account, per instance | ||

| 46 | Prepayment Charges for retail advances | No prepayment charges if the loan is adjusted by the borrower from his own verifiable legitimate sources. | |

| 47 | Charges for late payment of EMI | 2% PA additional interest on the overdue installment amount | |

| 48 | Charges on Bank Guarantee | 0.25% per annum on bank guarantee amount / minimum of Rs.250/- +GST 18% on Charges. |